CASE STUDY

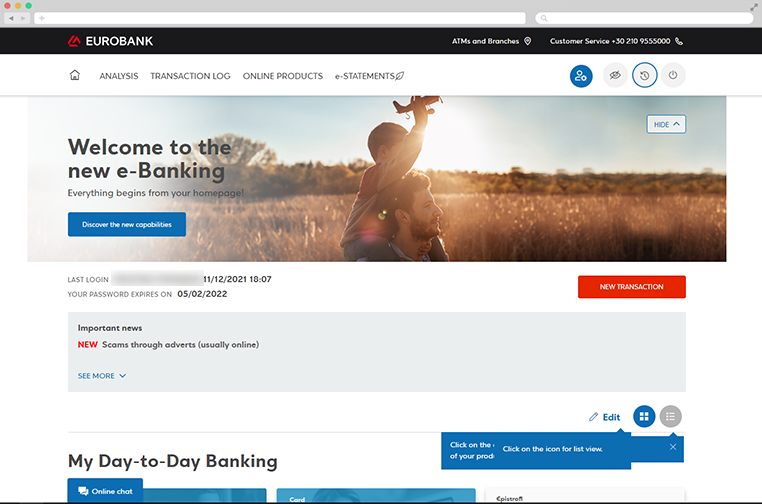

REINVENTING EUROBANK

The future of Omnichannel banking is here

modalTitle

CASE STUDY REINVENTING EUROBANK

THE CHALLENGE

The concept of banking is changing. Customer expectations for banking services are being reset. Every customer is a digital customer - irreversibly.

This is why Eurobank, a leader in Greece’s banking organisations, invests in business transformation through the integration of digital technologies. ATCOM was selected as the strategy and technology partner to modernise Eurobank’s presence across digital and physical channels and deliver innovative, personalised experiences.

STRATEGY

Working in agile teams and in close collaboration with the bank, we applied a UX-oriented Design Thinking approach, backed up by data and based on a solid, secure and high-performing infrastructure.

We met the challenge and reimagined every step of customer interaction with the bank. Reshaping the customer journey across all channels, we unified the experience through every touchpoint, from Eurobank’s e-banking platform and dedicated mobile application to the redesigned interface of Eurobank’s ATMs.

UNIQUE FEATURES

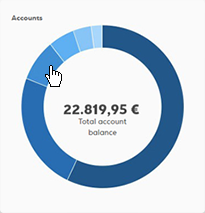

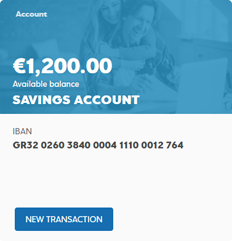

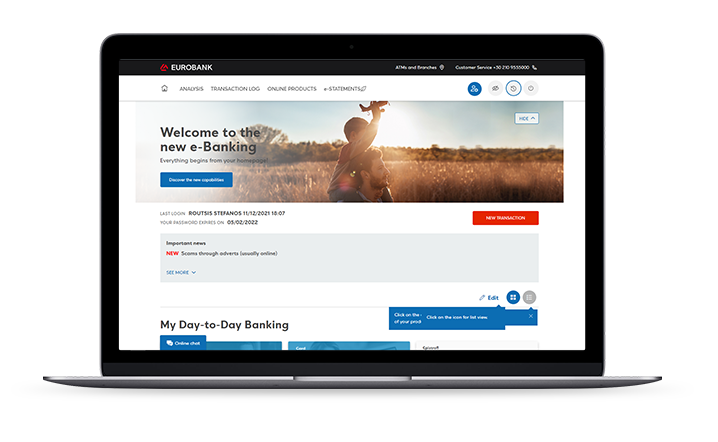

EUROBANK E-BANKING PLATFORM

- redesign & new UX approach

- customer-first strategy

- consistency, flexibility and reliability

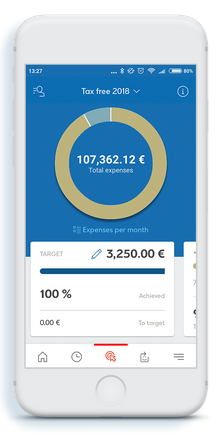

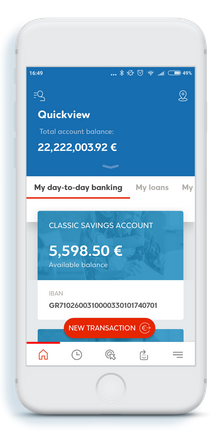

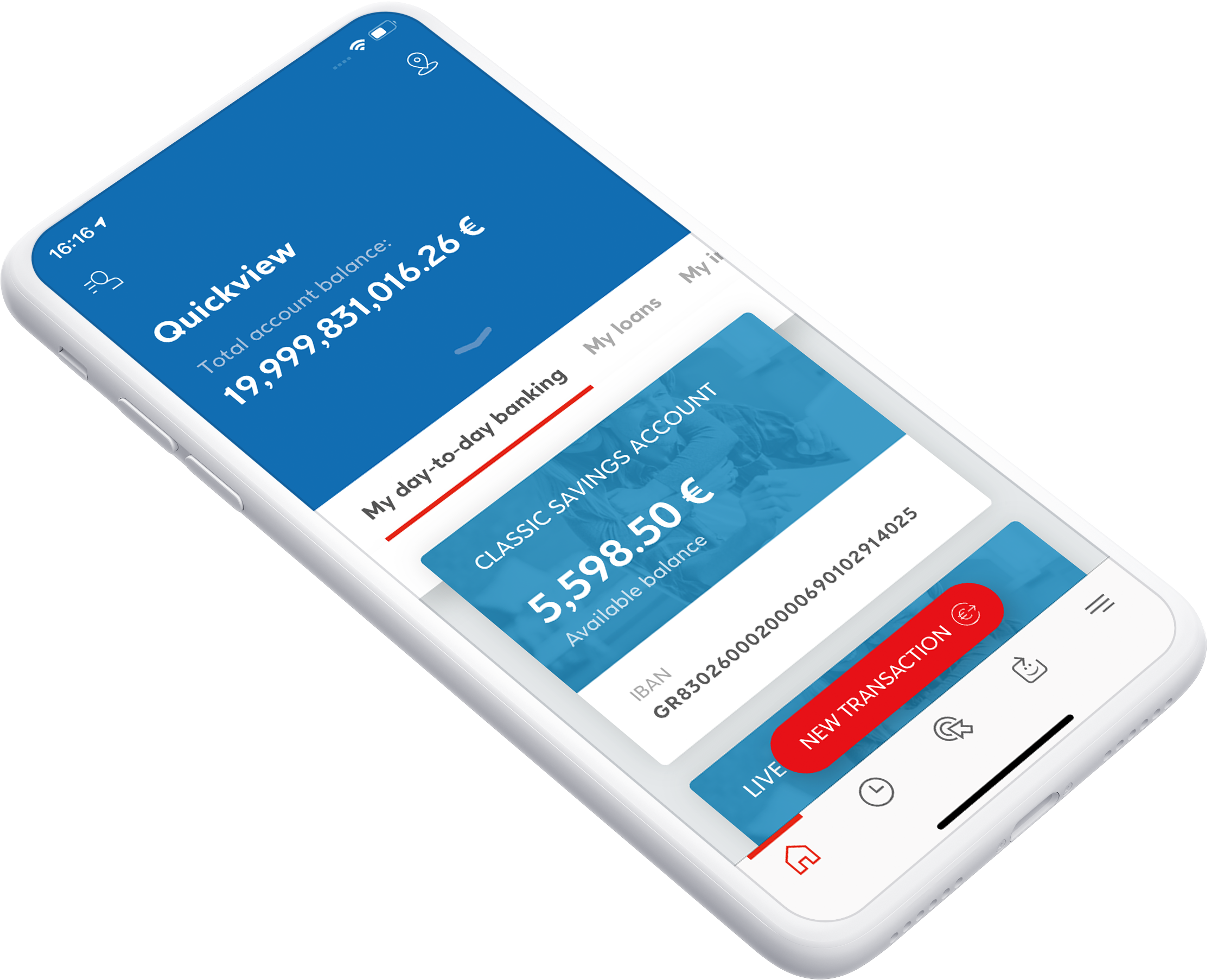

EUROBANK MOBILE APP

- redesign & implementation from scratch

- new levels of usability, security & scalability

- continuous updates

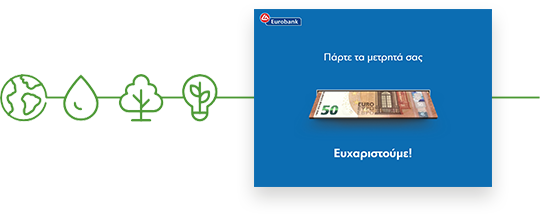

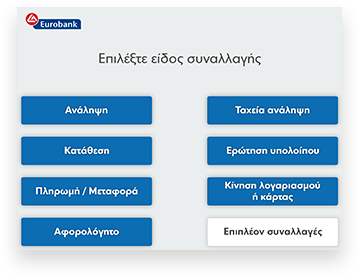

EUROBANK ATMs

- user interface redesign

- enhanced brand identity

- ensured usability

THE OUTCOME

With strategic innovation that delivers transformative results, we outlined an approach that breaks down the walls between channels, functions and operations, abandons outdated business models and changes assumptions about the relationship between banks and customers.

Our goal was not only to disrupt the digital banking ecosystem, but to transform every aspect of the customer’s banking experience and help create a new value proposition for modern banks. That’s what our Omnichannel strategy for Eurobank is all about.